M-Pesa Business Model: How Safaricom Makes Money

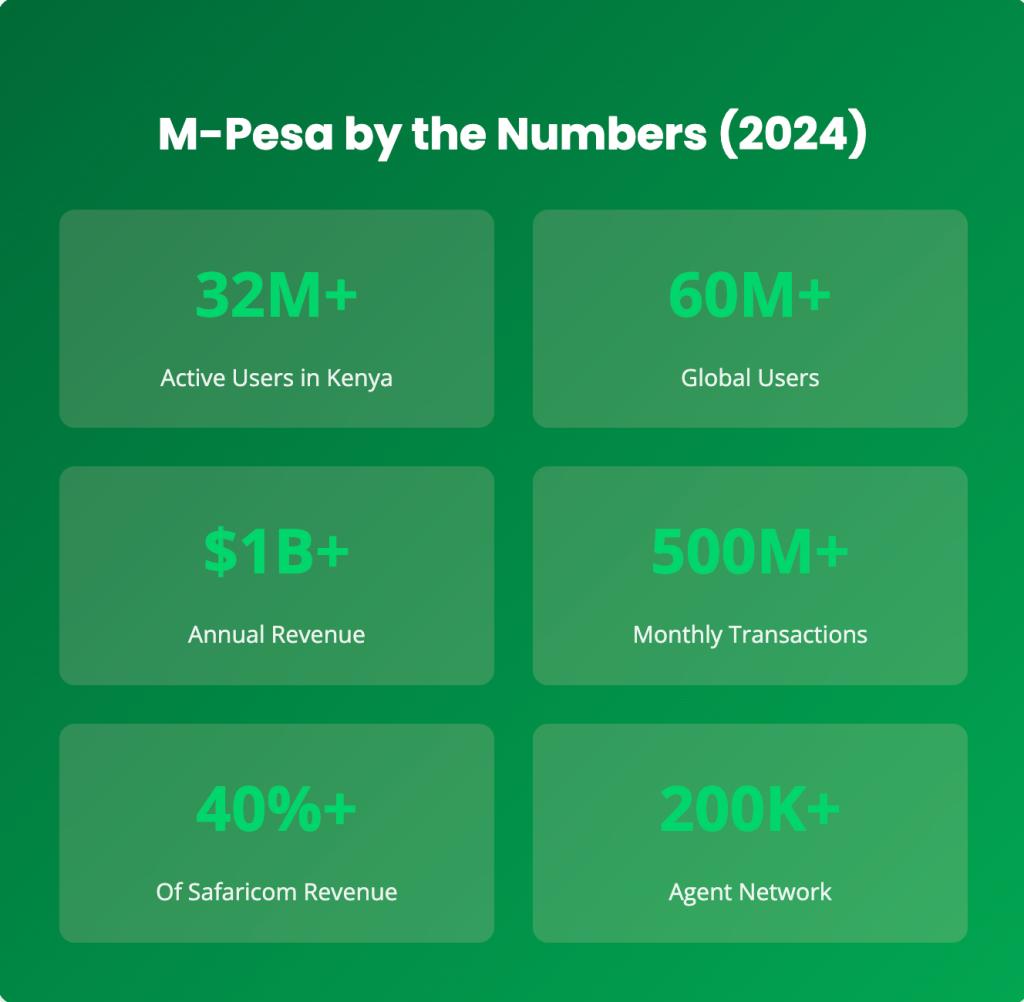

M-Pesa by the Numbers (2024)

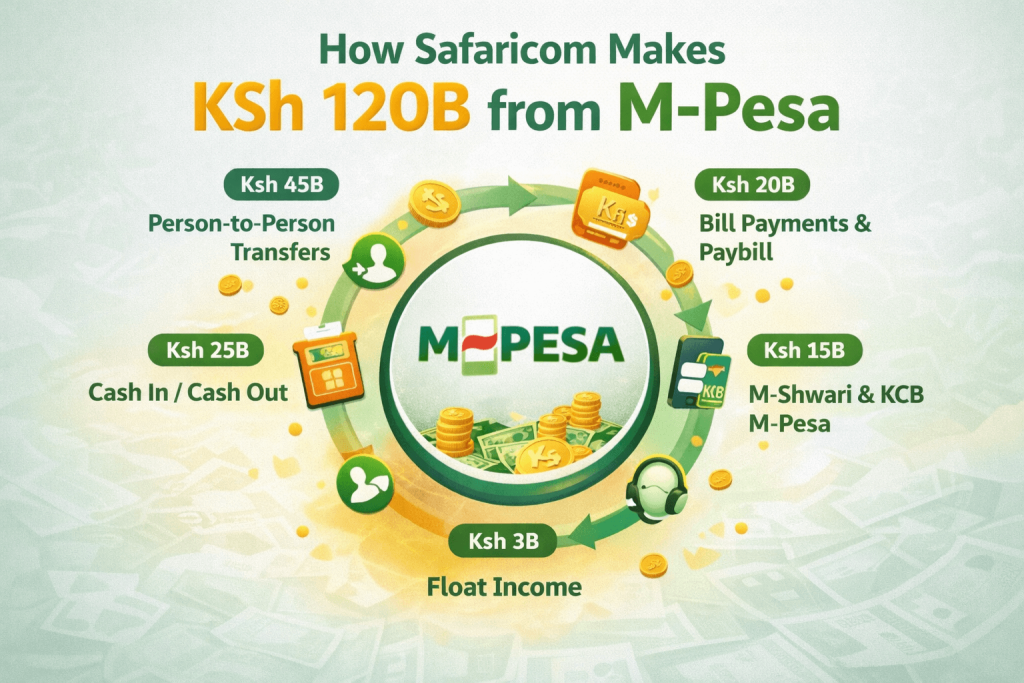

The M-Pesa Revenue Model: 7 Major Income Streams

| # | Revenue Stream | Estimated Share | How M-Pesa Earns |

|---|---|---|---|

| 1 | Person-to-Person Transfers | 35–40% | Transaction fees charged when users send money to other M-Pesa users. This is the original and largest revenue driver. |

| 2 | Bill Payments & Paybill | 20–25% | Fees from users paying utilities, businesses, and services via Paybill; merchants also pay Paybill service fees. |

| 3 | Cash In / Cash Out | 15–20% | Charges on cash deposits and withdrawals at M-Pesa agents, plus agent commission structures. |

| 4 | M-Pesa GlobalPay | 10–15% | Premium fees on international remittances and cross-border transfers, including forex conversion margins. |

| 5 | M-Shwari & KCB M-Pesa | 5–10% | Revenue sharing with banking partners from savings products and digital loans issued through the platform. |

| 6 | Merchant Services (Lipa Na M-Pesa) | 3–5% | Transaction fees paid by businesses accepting M-Pesa payments, plus integration and service charges. |

| 7 | Float Income | 2–3% | Interest earned on customer funds held temporarily in M-Pesa float accounts before withdrawal. |

Breaking Down the Transaction Fees

Person-to-Person Transfer Fees (Send Money)

| Transaction Amount (KES) | Fee Charged | Safaricom Revenue per Transaction |

|---|---|---|

| 1 – 100 | Free | KES 0 |

| 101 – 500 | KES 7 | KES 7 |

| 501 – 1,000 | KES 13 | KES 13 |

| 1,001 – 1,500 | KES 23 | KES 23 |

| 1,501 – 2,500 | KES 33 | KES 33 |

| 2,501 – 5,000 | KES 56 | KES 56 |

| 5,001 – 10,000 | KES 78 | KES 78 |

| 10,001 – 20,000 | KES 90 | KES 90 |

| 20,001 – 50,000 | KES 108 | KES 108 |

| 50,001 – 150,000 | KES 300 | KES 300 |

💡 Revenue Math Example

If 10 million users send an average of KES 2,000 five times per month:

Monthly Revenue = 10M users × 5 transactions × KES 33 fee = KES 1.65 billion ($12.5M)

Annual Revenue from P2P alone = KES 19.8 billion ($150M+)

Withdrawal Fees: Cash Out Economics

| Withdrawal Amount (KES) | Agent Fee | ATM Fee |

|---|---|---|

| 50 – 100 | KES 11 | KES 15 |

| 101 – 500 | KES 29 | KES 29 |

| 501 – 1,000 | KES 29 | KES 29 |

| 1,001 – 2,500 | KES 52 | KES 52 |

| 2,501 – 5,000 | KES 69 | KES 69 |

| 5,001 – 10,000 | KES 115 | KES 115 |

| 10,001 – 20,000 | KES 167 | KES 167 |

| 20,001 – 35,000 | KES 185 | KES 185 |

| 35,001 – 70,000 | KES 330 | KES 330 |

Important: Safaricom shares withdrawal fees with agents, typically keeping 40-50% and paying agents the remainder as commission for providing liquidity and customer service.

The M-Pesa Ecosystem: Beyond Transactions

How M-Pesa Creates a Financial Ecosystem

| Layer | Ecosystem Component | Description |

|---|---|---|

| 📱 | Core Platform | Enables money transfers, airtime purchases, and bill payments for everyday transactions. |

| 🏦 | Banking Services | Digital savings and credit products such as M-Shwari savings and KCB M-Pesa loans. |

| 🛒 | Merchant Payments | Business and consumer payments via Lipa Na M-Pesa and online checkout solutions. |

| 🌍 | Global Transfers | International money transfers through partners like Western Union and other remittance services. |

| 👥 | Agent Network | Over 200,000 agent outlets nationwide supporting cash deposits and withdrawals. |

| 🎯 | Business Solutions | Enterprise tools including Paybill numbers, bulk payments, and developer APIs. |

M-Shwari and KCB M-Pesa: The Banking Goldmine

How It Works

- M-Shwari (Partnership with NCBA): Instant savings accounts and loans accessed via M-Pesa menu

- KCB M-Pesa: Similar offering from KCB Bank with competitive rates

- Safaricom’s Role: Platform provider, customer acquisition, transaction facilitation

- Revenue Model: Safaricom receives 30-40% of the interest and fees generated by the banks

Why This Is Profitable

- Zero customer acquisition cost for Safaricom—users already on M-Pesa

- No credit risk—banks bear all lending risk

- Pure revenue share on billions in loan disbursements

- Recurring income from millions of active savers and borrowers

💰 The Numbers

M-Shwari: Over 30 million accounts opened, KES 250+ billion in loans disbursed since launch

KCB M-Pesa: 10+ million customers, KES 100+ billion in loans

Safaricom’s Take: Estimated KES 5-8 billion annually from banking partnerships

Merchant Services: Lipa Na M-Pesa

Business Model

Safaricom charges businesses that accept M-Pesa payments through “Buy Goods” and “Pay Bill” services:

- Transaction Fee: Typically 0.5-1.5% of transaction value

- Monthly Charges: KES 500-5,000 depending on business type and volume

- Integration Fees: One-time charges for API and system integration

- Till Number Fees: Charges for physical point-of-sale till numbers

Why Merchants Pay

- Access to 32+ million potential customers

- Instant payment settlement (no cash handling risks)

- Lower cost than card payment processors (2-3%)

- Digital record-keeping and reconciliation

- Customer preference—M-Pesa is king in Kenya

Float Income: The Hidden Revenue Stream

One of M-Pesa’s least discussed but most profitable revenue sources is float income—interest earned on the billions of shillings sitting in M-Pesa accounts.

How It Works

- Users deposit money into M-Pesa (electronic float)

- Money sits in trust accounts at partner banks

- Banks pay interest on these massive deposits

- Safaricom keeps most of the interest (users earn zero)

📊 Float Income Math

Average Daily Float: KES 80-100 billion ($600-750M)

Annual Interest (at 8%): KES 6.4-8 billion ($48-60M)

Note: This is essentially free money from customer balances that would otherwise sit idle

International Transfers: Premium Pricing

M-Pesa GlobalPay enables international money transfers, charged at premium rates due to currency conversion and cross-border complexity:

Fee Structure

- Kenya → Ethiopia: 1-2% of transfer value + fixed fee

- Kenya → Uganda/Tanzania: Similar regional rates

- Diaspora Remittances: Partnership with Western Union (revenue share)

- Typical Fee: 2-4% per transaction (vs. 0.5-1% domestic)

With diaspora remittances to Kenya exceeding $4 billion annually, even capturing 10-15% of this market generates substantial revenue.

The Network Effect: Why M-Pesa Keeps Growing

Virtuous Growth Cycle

- More Users → More valuable to merchants and senders

- More Merchants → More useful to users (bill payments, shopping)

- More Agents → Better access and convenience

- More Services → Increased stickiness and usage

- Higher Usage → More transaction revenue

This network effect creates a nearly unassailable competitive moat. New entrants face a chicken-and-egg problem: users won’t join without merchants, merchants won’t integrate without users.

The Business Model Genius of M-Pesa

M-Pesa’s brilliance lies in its multi-sided platform strategy:

- Charges users small fees on high-volume transactions (billions of transactions)

- Monetizes merchants through service fees and integration charges

- Earns revenue share from banking partners with zero risk

- Generates float income on customer balances

- Builds an ecosystem where every participant adds value to others

Result: 40%+ of Safaricom’s revenue from a platform that requires minimal infrastructure beyond the mobile network itself. Pure digital economics with 60-70% profit margins.

Cost Structure: Why M-Pesa Is So Profitable

Variable Costs (Relatively Low)

- Agent Commissions: 40-50% of withdrawal/deposit fees

- SMS Notifications: Minimal per-transaction cost

- Banking Partner Shares: 60-70% of M-Shwari revenue to banks

- Customer Support: Distributed across agent network

Fixed Costs (Highly Scalable)

- Platform Maintenance: Software, servers, security

- Regulatory Compliance: Central Bank reporting, audits

- Marketing: Brand maintenance and acquisition

- Staff: Relatively small team given scale

Key Advantage

M-Pesa leverages Safaricom’s existing infrastructure—network, distribution, brand—meaning incremental costs are minimal while revenue scales with transactions. This produces exceptional profitability.

Future Revenue Opportunities

- M-Pesa Africa (Ethiopia): Replicating Kenya success in 120M population

- E-Commerce Integration: Becoming the payment rail for online shopping

- Insurance Products: M-Pesa-linked micro-insurance offerings

- Investment Products: Government bonds, treasury bills via M-Pesa

- Cross-Border Expansion: Regional money movement corridor

- Cryptocurrency Integration: Digital asset on-ramp/off-ramp

- Super App Strategy: Adding ride-hailing, food delivery, e-commerce

Key Takeaways: The M-Pesa Money Machine

- M-Pesa generates 40%+ of Safaricom’s revenue from multiple complementary streams

- Person-to-person transfers remain the largest revenue source (35-40%)

- High-margin revenue from banking partnerships requires zero credit risk

- Float income provides “free money” from billions in customer balances

- Network effects create virtually unbreakable competitive moat

- Exceptional profitability (60-70% margins) due to digital scalability

- Ethiopia expansion could double M-Pesa revenue within 5-7 years

Conclusion

M-Pesa’s business model is a masterclass in platform economics. By charging small fees on massive transaction volumes, earning revenue shares from strategic partnerships, and monetizing customer balances, Safaricom has built one of Africa’s most profitable and resilient businesses.

The genius lies not in any single revenue stream but in the ecosystem that creates multiple monetization opportunities from the same customer base. Users pay for transactions, merchants pay for access, banks pay for distribution, and everyone benefits from the network effect.

As M-Pesa expands to Ethiopia and potentially other markets, this business model will continue printing money. For investors, understanding these revenue mechanics is crucial to appreciating why M-Pesa is worth billions and why Safaricom remains one of Africa’s most valuable companies.

M-Pesa didn’t just create a payment platform—it created a money-making machine that gets stronger with every transaction, every merchant, and every new user. That’s the power of platform economics done right.